Previous: Introduction To Islamic Finance: Capitalist vs Islamic Economy

ONE of the most important characteristics of Islamic financing is that it is an asset-backed financing.

The conventional / capitalist concept of financing is that the banks and financial institutions deal in money and monetary papers only. That is why they are forbidden, in most countries, from trading in goods and making inventories.

Islam, on the other hand, does not recognize money as a subject-matter of trade, except in some special cases.

Money has no intrinsic utility; it is only a medium of exchange; Each unit of money is 100% equal to another unit of the same denomination, therefore, there is no room for making profit through the exchange of these units inter se.

Profit is generated when something having intrinsic utility is sold for money or when different currencies are exchanged, one for another.

The profit earned through dealing in money (of the same currency) or the papers representing them is interest, hence prohibited.

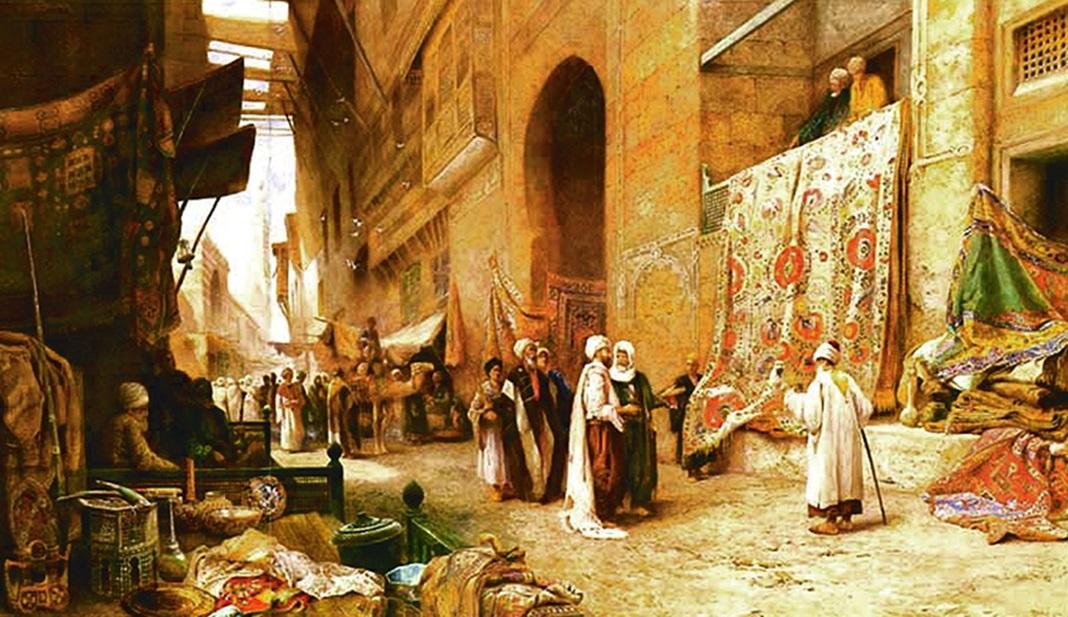

Therefore, unlike conventional financial institutions, financing in Islam is always based on illiquid assets which creates real assets and inventories. The real and ideal instruments of financing in Shari‘ah are musharakah and mudarabah.

When a financier contributes money on the basis of these two instruments it is bound to be converted into the assets having intrinsic utility. Profits are generated through the sale of these real assets.

Financing on the basis of salam and istisna‘ also creates real assets. The financier in the case of salam receives real goods and can make profit by selling them in the market. In the case of istisna, financing is effected through manufacturing some real assets, as a reward of which the financier earns profit.

Financial leases and murabahah, as will be seen later in the relevant chapters, are not originally modes of financing. But, in order to meet some needs they have been reshaped in a manner that they can be used as modes of financing, subject to certain conditions, in those sectors where musharakah, mudarabah, salam or istisna‘ are not workable for some reasons.

The instruments of leasing and murabahah are sometimes criticized on the ground that their net result is often the same as the net result of an interest-based borrowing. This criticism is justified to some extent, and that is why the Shari‘ah supervisory Boards are unanimous on the point that they are not ideal modes of financing and they should be used only in cases of need with full observation of the conditions prescribed by Shari‘ah.

Despite all this, the instruments of leasing and murabahah, too, are fully backed by assets and financing through these instruments is clearly distinguishable from the interest-based financing on the following grounds.

- In conventional financing, the financier gives money to his client as an interest-bearing loan, after which he has no concern as to how the money is used by the client.

In the case of murabahah, on the contrary, no money is advanced by the financier. Instead, the financier himself purchases the commodity required by the client.

Since this transaction cannot be completed unless the client assures the financier that he wishes to purchase a commodity, therefore, murabahah is not possible at all, unless the financier creates inventory.In this manner, financing is always backed by assets. - In the conventional financing system, loans may be advanced for any profitable purpose. A gambling casino can borrow money from a bank to develop its gambling business. A pornographic magazine or a company making nude films are as good customers of a conventional bank as a house-builder.

Thus, conventional financing is not bound by any divine or religious restrictions.But the Islamic banks and financial institutions cannot remain indifferent about the nature of the activity for which the facility is required. They cannot effect murabahah for any purpose which is either prohibited in Shari‘ah or is harmful to the moral health of the society. - It is one of the basic requirements for the validity of murabahah that the commodity is purchased by the financier which means that he assumes the risk of the commodity before selling it to the customer.

The profit claimed by the financier is the reward of the risk he assumes. No such risk is assumed in an interest-based loan. - In an interest bearing loan, the amount to be repaid by the borrower keeps on increasing with the passage of time. In murabahah, on the other hand, a selling price once agreed becomes and remains fixed.

As a result, even if the purchaser (client of the Bank) does not pay on time, the seller (Bank) cannot ask for a higher price, due to delay in settlement of dues. This is because in Shari‘ah, there is no concept of time due of money. - In leasing too, financing is offered through providing an asset having usufruct.

The risk of the leased property is assumed by the lessor / financier throughout the lease period in the sense that if the leased asset is totally destroyed without any misuse or negligence on the part of the lessee, it is the financier/lessor who will suffer the loss.

It is evident from the above discussion that every financing in an Islamic system creates real assets. This is true even in the case of murabahah and leasing, despite the fact that they are not believed to be ideal modes of financing and are often criticized for their being close to the interest-based financing in their net results.

It is known, on the other hand, that interest-based financing does not necessarily create real assets, therefore, the supply of money through the loans advanced by the financial institutions does not normally match with the real goods and services produced in the society, because the loans create artificial money through which the amount of money supply is increased, and sometimes multiplied without creating real assets in the same quantity.

This gap between the supply of money and production of real assets creates or fuels inflation. Since financing in an Islamic system is backed by assets, it is always matched with corresponding goods and services.

Limited free articles. Subscribe for full access.

Dr. Bilal Philips

Dr. Bilal Philips